Unpacking the Bridgetown Initiative

“Climate is the economic crisis of today” - Prof. Avanish Persaud

By Oshani Perera and Francine Picard, November 2022

The Bridgetown Initiative is one of the boldest ideas to be tabled at CoP 27. Proposed by Barbados's Prime Minister Mia Mottley and Prof Avinash Persaud, it addresses the nexus between climate finance, loss and damage, climate mitigation, and climate justice. We hugely welcome its ambition of serving as a Marshall Plan or a climate recovery plan that can provide additional affordable capital, at scale, to developing countries.

But perhaps, we need to work further on its design?

The Bridgetown Agenda

The Bridgetown Agenda aims to seed a US$ 500bn Global Climate Mitigation Trust, targeted at funding climate mitigation projects in poor countries. It is to be capitalized by the IMF Special Drawing Rights (SDR), with potential contributions from the windfall profits of fossil fuels energy supply chains and complemented with debt relief for poor countries.

In terms of operation, the Trust will use SDR as a security to borrow a further US$ 500bn from capital markets, keep renewing these loans, and spread the currency risks across the SDR currencies – the euro, U.S. dollar, Chinese renminbi, Japanese yen, and the British pound sterling. The Trust will then on-lend the money it raises to mitigation projects, divided across different tranches of risks. Eligible projects will be those that can lower greenhouse gas emissions which will be assessed on the mitigation potential per unit of investment.

Challenges

The biggest challenge to the Bridgetown Agenda will be seeding the fund through SDR. Both the IMF member countries and the IMF itself may not find this palatable. We have, for many years, advocated for SDR-seeded funds targeted at the SDGs, to mitigate soil degradation, build sustainable infrastructure, to reforest and to scale low-carbon technologies. In 2021, experts also suggest a Zero Hunger Bond, that could be partly financed by SDRs. But there has been little appetite. SDRs are an asset and accounting unit for IMF transactions with their member nations. As such, it is a stable asset in IMF member countries' international reserves and many countries remain very hesitant to ‘give up’ their reserves.

Instead, would richer countries be more willing to directly seed such a trust? Or even better, would they be ready to offer guarantees in SDR currencies to credit enhance mitigation projects? In food and agriculture, mitigation projects range from regenerative agriculture, agroforestry and low-carbon technologies for food processing, storage, and distribution. Given the perceived performance risks of such ventures, guarantees and de-risking capital is particularly important.

We also question if the Trust will find a strong pipeline of credit-worthy mitigation projects in developing countries. Climate capital and sustainable/green funds more broadly continuously struggle to find suitable projects. Similarly, donor-funded credit lines targeting upgrades ranging from energy efficiency to agroforestry, remain largely untapped. This is in part a testament to the reality that many developing countries don’t have the necessary skills to develop strong projects and from there on, package and present these projects in proposals that are convincing to public and private capital holders. We, therefore, suggest that the Bridgetown Agenda incorporate a multi-disciplinary project preparation service to help developing countries put forward mitigation projects that meet its eligibility criteria.

Given that the Trust is targeting projects, we also foresee challenges related to poorly designed public-private partnerships (PPPs). Many of the projects funded by the Trust are likely to be designed as PPPs, especially in agriculture, food production and food processing. PPP projects often require sovereign guarantees and these obligations are often structured as off-balance sheet sovereign debt. This can pose challenges for debt-burdened developing countries for it is always easier to underestimate future debt obligations when one is hard-pressed to service current ones. If projects funded by the Trust increase off-balance-sheet sovereign debt, the entire goal of the Bridgetown Agenda will be lost.

The IMF is already calling for PPP related obligations to be maintained on balance sheet. They have been using the IMF PPP Fiscal Risk Assessment Model (PFRAM) to stress test the costs and risks of PPP-related debt on public balance sheets. This reinforces the importance for the Trust to offer an accompanying project preparation service that could advise developing countries on how to design PPP projects that will provide value for money across the asset life cycle.

Next Steps

The Shamba Centre for Food and Climate is ready to work with the Bridgetown Initiative to expand the debate on the design of the Trust and moreover, position agriculture and food systems as a primary beneficiary sector. These sectors account for sizable portions of GDP and employment in developing countries, but receive only 3 percent of global climate financing. The primary reasons may be that food systems pathways are yet to align on Net Zero GHG emissions, Nationally Determined Contributions do not sufficiently embed food and agriculture and the same is true for National Adaptation Plans.

These are lost opportunities for low-carbon innovation in food and agriculture which range from modern agroforestry and urban agriculture to plant-based proteins and precision farming. But we need more certainty and predictability of the performance of these approaches/technologies. This includes track records that show that they are not yield and revenue blind and moreover, offer a host of quantifiable co-benefits including climate mitigation and adaptation. Farmers, producers, and entrepreneurs also need advice on borrowing and guarantees from blended capital.

We need to wake up to the reality that:

Markets lend to developing countries at much higher interest rates than they do to developed nations.

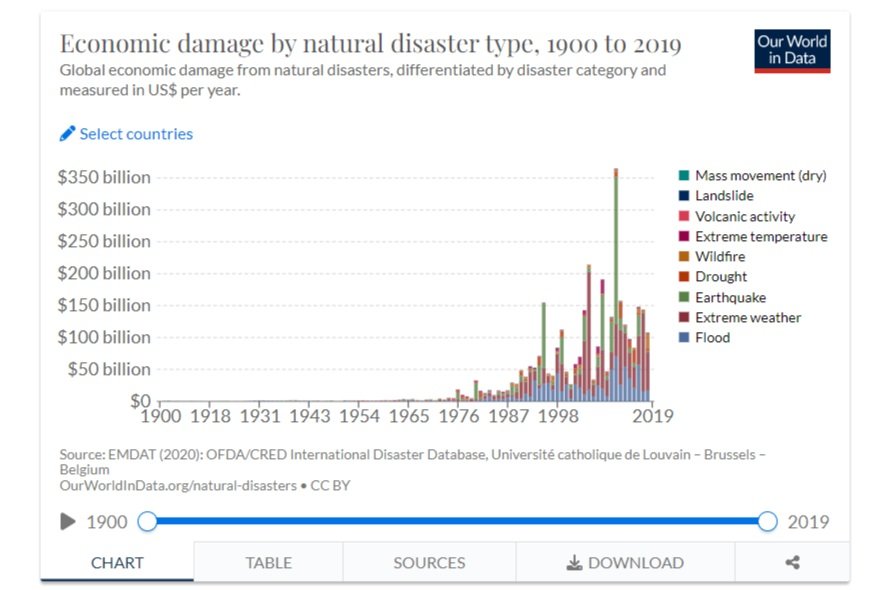

Extreme weather is ripping away at larger proportions of the GDP of poorer nations, the recent floods in Pakistan cost over 10% of the GDP.

The sovereign debt of developing countries is unsustainable, the IMF reports that as of February 2022, 23 African countries are either in debt distress or at risk of it.

When faced with such realities, affordable capital for food and agriculture in poor countries is a massive problem. Private sector borrowing rates are a premium above government rates and when developing nations are borrowing at interest rates akin to 11% to 15%, the cost of capital for low-carbon investments can reach anywhere between 15% to 17%. In richer countries, by comparison, where governments are borrowing at 2%, the cost of financing low-carbon projects will be around 5%.

This is the climate finance inequality that the Bridgetown Initiative aims to rectify. Prime Minister Mottley and Prof Persaud are right to argue that a systemic change is needed across the global financial system if capital is to flow, in scale and to curb climate change. But to access affordable capital, developing countries must also rise to the challenge. They need to be proactive and ambitious on mitigation and adaptation strategies and improve governance, transparency, and accountability across the board. Capital will remain expensive till these fundamentals improve.

The Bridgetown Initiative has the potential to put developing countries and their food and agriculture sector on the path to net zero. Let work on design, redesign, debate, and implementation begin.

References

International Monetary Fund; Special Drawing Rights. Posted at https://www.imf.org/en/Topics/special-drawing-right

Ministry of Foreign Affairs and Foreign Trade, Barbados; The 2022 Bridgetown Initiative. November 2022. Posted at https://www.foreign.gov.bb/the-2022-barbados-agenda/

Osborn, C; The Barbadian Proposal Turning Heads at COP27, Foreign Policy, November 20222. Posted at https://foreignpolicy.com/2022/11/11/cop27-un-climate-barbados-mottley-climate-finance-imf/

Rowling M; Explainer: What's the plan to fill the climate finance gap for poor nations; Reuters; November 2022. Posted at https://www.reuters.com/business/cop/whats-plan-fill-climate-finance-gap-poor-nations-2022-11-10/

Photo by Will Turner on Unsplash