What is outcome finance?

Can we have more impact if we focus on outcomes?

Work in sustainable development focuses on deliverables and outputs. We draw up contracts on deliverables and report on the outputs. We are so busy delivering outputs that we do not ask: is our work creating measurable outcomes on the UN Sustainable Development Goals (SDGs)?

Design with the end in mind

Focusing on outcomes is powerful as it forces us to design with the end in mind.

For example, if we want to increase agriculture productivity by 5% in Rwanda, we will not write reports or spend too much time speaking to policy makers. Instead, we will look for ways to ‘pay’ and reward farmers who will work with us to improve their long-term productivity.

In year 1, we might pay farmers to cover crop and introduce buffers to reduce soil erosion and nitrate and phosphorus runoff. This will stabilise soils in the medium term.

Then, we may pay farmers to plant more trees crops and nutritious leafy greens to further conserve soil, sequester carbon and improve resilience, diversity, and productivity of the farming landscape.

Finally, we might make further payments for renewable powered on-farm solar dehydrators that drastically reduce post-harvest losses and increase revenue from value addition on the farm.

We are now four years into the project and have achieved measurable outcomes in:

carbon sequestration,

reduced erosion and better water quality in rivers and lakes,

increased biodiversity,

improved nutrition, and

increased farm income.

And what if we can ‘sell’ these outcomes to donors and philanthropic foundations who spend billions to achieve these outcomes? Even better, we could work with companies who will buy these measured and verified ‘outcomes’ when they are produced within their supply chains? One of the biggest concerns of agri-food businesses is the volatility of supply, driven in part by climate change and the overshoot of other planetary boundaries.

How this work?

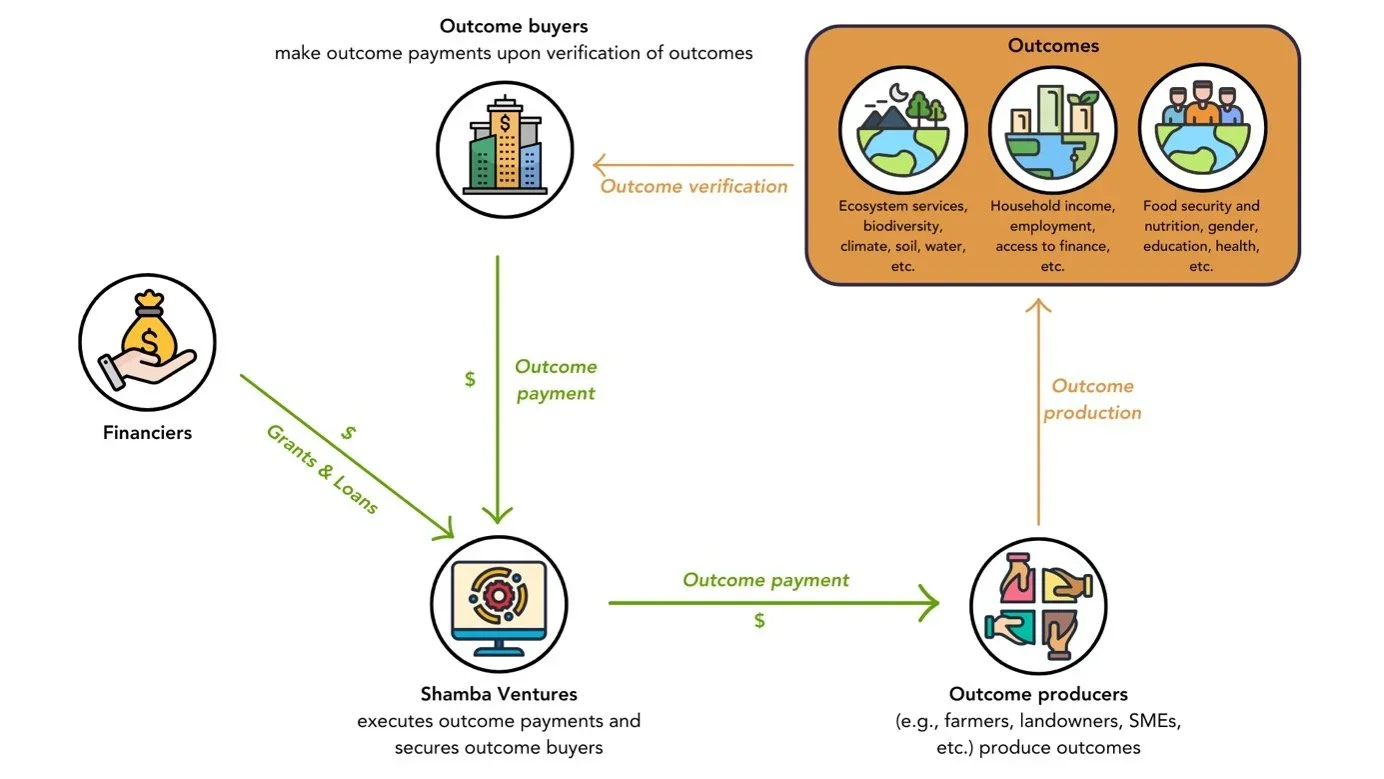

Low-interest loans are used to make ‘payments’ to farmers, SMEs and landowners to deliver pre-agreed outcomes. Once the outcomes are achieved, measured and verified, they are then ‘sold’ to donors and companies.

We are now implementing the ‘market mechanisms’ as called for in the Paris Agreement and the Global Biodiversity Framework. In addition, we are creating markets for public goods and services that currently remain undervalued by our current economic and financial systems.

-

5 reasons why the Shamba Centre is betting on outcome-based finance

-

Becoming the change we want to see: implementing outcome finance

-

Five bold ideas to finance sustainable food systems

-

Beyond SOFI 2024: Five innovative ideas to finance food security and nutrition